Cool little game from the WSJ that puts YOU in the driver’s seat of US monetary policy.

Monthly Archives: May 2013

Startup Lessons From Peter Thiel

If you are an entrepreneur, deal with startups, or have seen the movie The Social Network then you’ve probably at least heard of Peter Thiel. He was one of the founders of PayPal, the first outside investor in Facebook, and has made countless other investments through the various funds he manages (Founders Fund, Clarium, Mithril, etc.). In short, the man is not some one trick pony that got lucky a couple of times. His advice is valuable; when he speaks you should listen – especially if you’re involved with startups.

Last year he taught a startup class at Stanford. As you might imagine it was incredibly popular and hard to get into. Fortunately for those of us that were unable to attend, one of the more diligent students not only took incredibly robust class notes but decided to share them with the world through his blog http://blakemasters.com/.

You can check out his notes here: Peter Thiel’s CS183: Startup Class Notes.

Thank you Blake, thank you PT. A few notable quotes highlighted on Pinterest of all places are below:

Five Good Things to Know About Investing

Every now and then you stumble upon a good article on Motley Fool. One that grabbed my attention is If You Only Know 5 Things About Investing, Make It These. I normally don’t bother with articles like these but this one is pretty good. I think a more suitable title would have been less definitive: “Five good things to know about investing”.

The list is as follows – go read the article to get the full explanation and context:

- Compound interest is what will make you rich. And it takes time.

- The single largest variable that affects returns is valuations — and you have no idea what they’ll do

- Simple is usually better than smart

- The odds of the stock market experiencing high volatility are 100%

- The industry is dominated by cranks, charlatans, and salesman

Corporate Tax Rates

They say the only things guaranteed in life are death and taxes… unless you’re a corporation. Yes, a corporation can hypothetically live forever and, as it turns out, they don’t always have to pay taxes. Cool interactive graphic from the NYT regarding US corporate tax rates:

Found via The Big Picture

Found via The Big Picture

Another Reason to Love Your Phone Company

Interesting WSJ article about how major telcos are mining and selling their your data to marketers. Just in case you didn’t already feel like you live in some kind of Orwellian surveillance state. Something tells me this new revenue stream won’t go toward lowering your cell phone bill.

I Wanna Go Fast

Apollo 10 could have taken you from SF to NYC in less time than it takes you to shower.

Found via Cool Infographics

It is the Best of Times and it is the Worst of Times

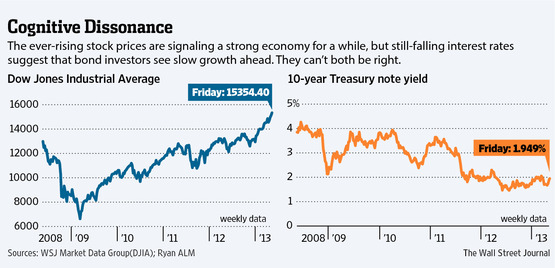

There is a good article in the WSJ about the current investing landscape called Is This the Best Time for Investors? Don’t Bet On It – it is behind their paywall but usually if you google the headline you can get the articles for free. The whole article is good but my favorite part is the simple thought experiment offered by Rob Arnott regarding the importance of QE:

How important is [quantitative easing] to asset prices? Some say it is the main story. Rob Arnott, chairman of Research Affiliates in Newport Beach, Calif., suggests investors engage in a simple thought experiment to understand.

Imagine, he says, if Mr. Bernanke announced tomorrow that he would end this policy forever. “Ninety-nine people out of a hundred” on Wall Street, Mr. Arnott says with a chuckle, know full well what would happen immediately: clattering falls of both stocks and bonds.

The United States of Energy

To The Graduating Class of…

‘Tis the season for high minded and inspirational graduation speeches. The first one below is interesting because it is the first graduation speech I’ve seen delve into the monotony of adult life and the early days of one’s career and from that illustrate the importance education, choice, and attitude.

Of course it’s hard to beat Steve Job’s commencement address in 2005. Both are well worth your time.

Found via Jan S. (soft J)

IBM 305 RAMAC

“Here is a data processing machine that is beautifully designed. A machine whose compact, integrated construction makes possible a multitude of operations…”

Yes, but does it have minesweeper?