From Security Analysis, 1940 edition:

Investing

Money for Nothing and Fees for Free

Great Reuters article about an incredibly common practice in the world of PE (and VC) – funds sitting on assets for the sole purpose of collecting fees.

Generally these funds have a 5 year period to make investments, after that period comes to pass a fund generally switches into “harvesting” mode where the GPs work to realize (sell) the assets and return money to LPs (investors). But because of the way GPs are compensated they actually have the perverse incentive NOT to return your money or realize many of the investments.

You see if the fund has a 10 year life and the GP is paid 2% per year on the dollar value of the investments then why give that up? Sure it will piss off the LPs but the GPs will likely be on to their next fund before that happens. Money for nothing and fees for free.

The article is more enjoyable if read while listening to this.

Reuters: More than $100 billion trapped in ‘zombie funds:’ industry data

Klarman on Fundamental Analysis

Some investors insist on trying to obtain perfect knowledge about their impending investments, researching companies until they think they know everything there is to know about them. They study the industry and the competition, contact former employees, industry consultants, and analysts, and become personally acquainted with top management. They analyze financial statements for the past decade and stock price trends for even longer.

This diligence is admirable, but it has two shortcomings. First, no matter how much research is performed, some information always remains elusive; investors have to learn to live with less than complete information. Second, even if an investor could know all the facts about an investment, he or she would not necessarily profit. This is not to say that fundamental analysis is not useful. It certainly is.

But information generally follows the well-known 80/20 rule: the first 80 percent of the available information is gathered in the first 20 percent of the time spent. The value of in-depth fundamental analysis is subject to diminishing marginal returns.

Most investors strive fruitlessly for certainty and precision, avoiding situations in which information is difficult to obtain. Yet high uncertainty is frequently accompanied by low prices. By the time the uncertainty is resolved, prices are likely to have risen.

Investors frequently benefit from making investment decisions with less than perfect knowledge and are well rewarded for bearing the risk of uncertainty. The time other investors spend delving into the last unanswered detail may cost them the chance to buy in at prices so low that they offer a margin of safety despite the incomplete information.

Ritholtz: Romancing Alpha, Forsaking Beta

You don’t have to follow this blog very closely to know I’m a big fan of Barry Ritholtz and his blog The Big Picture. Over the weekend he gave the following presentation, Romancing Alpha, Forsaking Beta at the Trustee Leadership Forum for Retirement Security.

It’s a great presentation that shows how our wetware (to borrow a term from Barry) leads to poor investment decisions – particularly when it comes to the mythical creatures of Wall Street: alpha generating hedge funds. Check it out:

The Adaptive Markets Hypothesis (AMH)

At last! A compromise between the Efficient Market Hypothesis (EMH) and Behavioral Finance:

Beware of Margin Debt

Really nasty market sell offs are notoriously hard to predict. But one factor that can propel a healthy sell off into a nasty sell off is margin debt. When investors become especially bullish they like to increase the size of their bets by borrowing money from their broker and using the stock they’re buying as collateral. This has the effect of magnifying the gains and the losses. When those bets go sour, investors have to raise cash to meet margin requirements (i.e. you have to post a certain level of cash or securities in proportion to what you borrowed) – if they’re already over extended and using borrowed money to buy stocks then they have to sell their stock in order to raise that cash. This is known as forced selling and it is something you never, ever want to do.

The SEC actually has a nice little summary of how margin works and highlights the following risks:

- You can lose more money than you have invested;

- You may have to deposit additional cash or securities in your account on short notice to cover market losses;

- You may be forced to sell some or all of your securities when falling stock prices reduce the value of your securities; and

- Your brokerage firm may sell some or all of your securities without consulting you to pay off the loan it made to you.

A recent NYT article highlights the margin debt “danger zone” at 2.25% of GDP. According to their research, when that threshold is breached, bad things generally happen – see charts below.

Between high corporate profit margins, the threat of QE being dialed back, and high levels of margin debt – it seems the seeds for a considerable market correction have been sewn. Buyer beware.

Five Good Things to Know About Investing

Every now and then you stumble upon a good article on Motley Fool. One that grabbed my attention is If You Only Know 5 Things About Investing, Make It These. I normally don’t bother with articles like these but this one is pretty good. I think a more suitable title would have been less definitive: “Five good things to know about investing”.

The list is as follows – go read the article to get the full explanation and context:

- Compound interest is what will make you rich. And it takes time.

- The single largest variable that affects returns is valuations — and you have no idea what they’ll do

- Simple is usually better than smart

- The odds of the stock market experiencing high volatility are 100%

- The industry is dominated by cranks, charlatans, and salesman

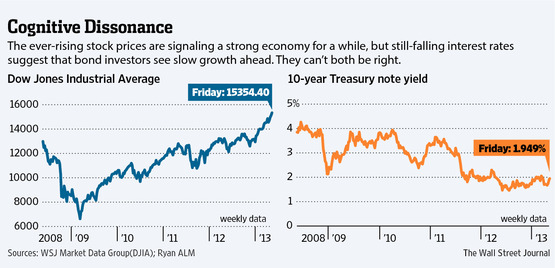

It is the Best of Times and it is the Worst of Times

There is a good article in the WSJ about the current investing landscape called Is This the Best Time for Investors? Don’t Bet On It – it is behind their paywall but usually if you google the headline you can get the articles for free. The whole article is good but my favorite part is the simple thought experiment offered by Rob Arnott regarding the importance of QE:

How important is [quantitative easing] to asset prices? Some say it is the main story. Rob Arnott, chairman of Research Affiliates in Newport Beach, Calif., suggests investors engage in a simple thought experiment to understand.

Imagine, he says, if Mr. Bernanke announced tomorrow that he would end this policy forever. “Ninety-nine people out of a hundred” on Wall Street, Mr. Arnott says with a chuckle, know full well what would happen immediately: clattering falls of both stocks and bonds.

Crowdfunding Real Estate

Interesting NYT article about some new crowdfunding platforms that let smaller investors invest in commercial real estate projects. Not a lot of detail about the finer points of the investment are offered up (like can you sell your interest and get your money back? When?) but it seems like an elegant way to invest in real estate. I’ve been a long time investor through Lending Club and this is basically the same model but with different underlying investment characteristics.

The democratization of community development was one aspect of the article that really struck me. This would be a cool mechanism to allow people to invest locally in real estate and have some influence in shaping their community (as opposed to REITs or PE shops based elsewhere).

I’m not sure it pays to be one of the earliest adopters of these real estate platforms but I think they’re worth keeping an eye on / studying further.

The platforms: Fundrise and Realty Mogul

For He Is An Investor

After that last post about famous speculators and their speculations I have to balance things out a bit…

“For as long as I can remember, veteran businessmen and investors – I among them – have been warning about the dangers of irrational stock speculation and hammering away at the theme that stock certificates are deeds of ownership and not betting slips… The professional investor has no choice but to sit by quietly while the mob has its day, until the enthusiasm or panic of the speculators and non-professionals has been spent. He is not impatient, nor is he even in a very great hurry, for he is an investor, not a gambler or a speculator. The seeds of any bust are inherent in any boom that outstrips the pace of whatever solid factors gave it its impetus in the first place. There are no safeguards that can protect the emotional investor from himself.”

– J. Paul Getty

Found via Hussman

Naturally, Hussman’s broader market commentary is equally as thought provoking as the introductory quote above. He identifies two aspects of QE that are driving the stock market: (1) the pain of zero interest cash and (2) the superstition that QE removes downside risk.

This got me thinking about all the folks out there who feel they are “forced into equities” because they can’t find adequate returns elsewhere. Yes, thus far the outcome has been quite nice for those “forced” into the stock market but at some point there will be a correction. And at some further point the Fed is going to take the punch bowl away. So rather than sulk about cash’s paltry return, why not recognize the option value embedded in cash? It is essentially a put option on every asset in the world with no expiration. Yes it won’t feel very valuable when the stock market is setting records but it will when the market changes course. I would gladly accept a year or two of 0% to slightly negative real returns (cash today) if in a few years time I can safely find double digit annualized returns elsewhere; ESPECIALLY if the only other offer on the table carries such considerable downside risk (i.e. stocks & bonds today). Today this thinking / approach is as unpopular as it is boring: very.

Let’s end this post with the money shot from Hussman’s commentary (and please keep in mind price ≠ value):

In short, there is no transmission mechanism by which QE has any large and beneficial effect on the value of equities. There has certainly been an effect on price – but this effect is driven by the willingness of investors to abandon their demand for a risk premium that will actually compensate them for the risk they are taking.