Yesterday Bloomberg ran a great op-ed piece by Dean Curnutt of Macro Risk Advisors called Be Very Afraid of When Fear Disappears From Markets. Observing the growing complacency in the markets today, he offers a word of warning – mainly that prices are failing to reflect the underlying financial reality and risks. In other words, prices are too high to offer an investment return sufficient to offset the associated risk. And why is that? Well, it’s a complicated answer but there is a group of culprits that stand out: The Federal Reserve / Central Banks of the world.

* * *

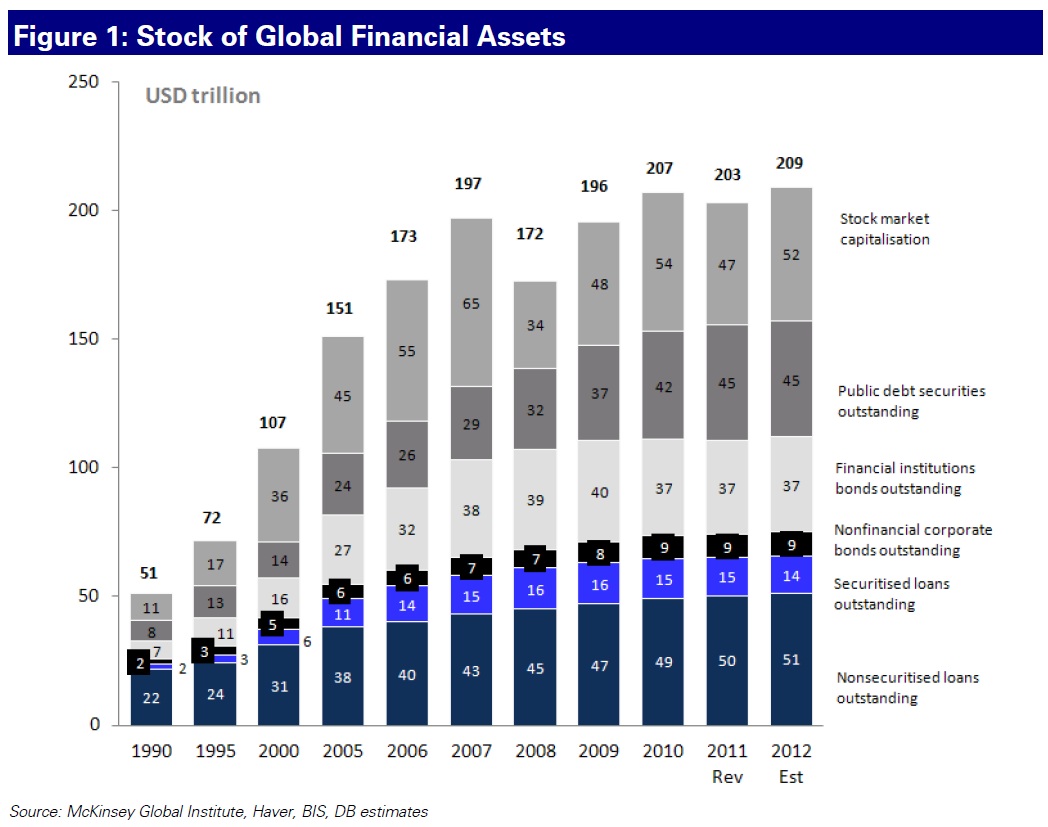

Quantitative Easing (QE) In a Nutshell – The price of US Treasuries is being manipulated by the Fed to keep interest rates low. The Fed buys massive amounts of US Treasuries which drives the price of them up and the interest rate on them down. This has the effect of driving up prices and lowering interest rates in other assets as well. This is why you can buy a house with a <4% interest rate (when my Dad bought his first house in the 1980s his interest rate was 16%!). So, what is a pension fund to do if they can no longer buy 10 Year Treasuries that yield 5-7% interest (they currently yield 1.95%) and they have to grow their fund at 8% just to make ends meet? That pension fund has to buy riskier assets that promise (but don’t always deliver) higher returns such as stocks or high yield bonds. This has the effect of raising prices and lowering yields for these assets. This effect of rising prices is essentially transmitted into every asset there is.

* * *

When risk is “under priced” bad things happen (ex. the dot com bubble of the early 2000s, the housing bubble of 2007, and now government debt). As we all know the US owes A LOT of money, and generally when someone already owes a lot of money they have a hard time borrowing more money. If you were lending money to a friend who was already in a lot of debt you’d recognize how risky the loan is and either (i) not loan them the money or (ii) demand a really high interest rate to compensate you for the risk you’re taking. Not so with the US government. People keep lending them more and more money at a lower and lower rate (keep in mind when you buy a US Treasury bond you are loaning them govt. money).

How does this end? Good question, nobody’s sure. It seems everyone can agree it’s not sustainable. There used to be “Bond Vigilantes” that would keep government borrowing in check – if a government started borrowing more than they could afford, the bond market would turn against them and start demanding higher interest rates as opposed to lower interest rates. The Fed has effectively killed the Bond Vigilantes because nobody wants to fight the Fed.

Because US Government debt is being mispriced (overpriced), that means just about every other asset out there is being mispriced (overpriced). Paraphrasing the article, “the prices are lying to you”. So the trillion dollar question is, when does this end? Nobody knows for sure but the people that can figure it out will make a lot of money at the expense of those who cannot.