Apollo 10 could have taken you from SF to NYC in less time than it takes you to shower.

Found via Cool Infographics

Apollo 10 could have taken you from SF to NYC in less time than it takes you to shower.

Found via Cool Infographics

‘Tis the season for high minded and inspirational graduation speeches. The first one below is interesting because it is the first graduation speech I’ve seen delve into the monotony of adult life and the early days of one’s career and from that illustrate the importance education, choice, and attitude.

Of course it’s hard to beat Steve Job’s commencement address in 2005. Both are well worth your time.

Found via Jan S. (soft J)

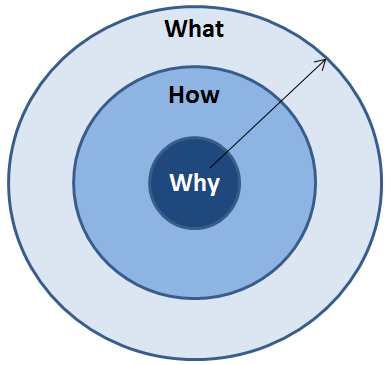

Simon Sinek: How great leaders inspire action

I’ve been periodically watching this video for a few years and I’ve been meaning to blog about it for quite a while. This 20 minute talk is well worth your time – the concept is simple but resonates incredibly well.

The punchline: why you do something is more important than what you do or how you do it. That’s not to say the “how” or “what” aren’t important but it’s the “why” that ranks supreme. People don’t buy what you do, they buy why you do it.

There are leaders and there are those who lead. Leaders are people with power and authority, we follow them because we have to. Those who lead inspire us, we follow them because we want to.

The Golden Circle

Barry Ritholz of The Big Picture blog posted a BuzzFeed article called 35 Astounding and Uplifting Facts About The Universe. All 35 are pretty good but the ones below really stuck in my head. Yes, they could be cheesy posters in a stoner’s dorm room but they’re interesting thoughts nonetheless. Also, I have no idea if the numbers presented are accurate and I have no intention to check – enjoy them at your own risk.

… that’ll push your wig back.

Runner up: Who Ate The Internet?

From the folks at Quartz – these are just the highlights – check out the full article here

In today’s financial world, the line between investing and speculation are often blurred. What is the real distinction between the two? Jason Zweig endeavors to answer that on The Wall Street Journal’s Total Return blog.

“As Josh Brown at the Reformed Broker pointed out earlier this week, nearly all commentary about the financial markets is tailored to speculators, not investors,” Zweig writes. “That can contaminate the mind of even the most intelligent investor with speculative thinking. How can you keep your head clear?”

Zweig notes that up until the 20th century (and for a good chunk of that century), all stocks were considered speculative. Bonds were considered investments, because they guaranteed a return of capital. The late, great Benjamin Graham helped change that. “He wanted people to see things differently,” Zweig writes. “Graham insisted that stocks could be investments and bonds could be speculations – all dependent on the…

View original post 164 more words

H/T: The Big Picture